Unlocking Financial Liberty: The Key Benefits of Enlisting Specialist Credit Report Coaching Provider

Navigating the complicated world of individual finance can be a difficult task, specifically when confronted with mounting debts and vague paths to monetary security. In such conditions, looking for the support of skilled credit score coaching solutions can supply a lifeline for individuals striving to gain back control over their monetary well-being. These solutions use an array of benefits, from customized financial debt management plans to approaches for boosting credit report and bargaining with financial institutions. However, the real worth lies not only in these tangible benefits yet likewise in the chance for economic education and learning, empowerment, and ongoing support that can lead the way towards a future complimentary from the irons of financial obligation.

Tailored Financial Debt Management Plans

Customized debt management strategies use a systematic approach to help people gain back control of their funds by creating a personalized roadmap to address their details monetary obstacles. By working carefully with a credit scores therapy agency or monetary expert, individuals can establish a strategy that consolidates their financial debts, negotiates with lenders for reduced interest rates or lowered payments, and establishes a workable settlement timetable.

Financial Education and Empowerment

Tailored financial obligation administration plans not only use a strategic structure for people to address their financial obstacles yet additionally offer as a driver for enhancing financial proficiency and empowerment with extensive financial education programs. By involving in experienced credit score counseling services, people access to valuable sources and advice that can help them understand important monetary concepts, such as budgeting, conserving, and investing. With individually sessions and workshops, credit scores counselors supply useful expertise on handling debt properly, improving credit report, and making educated economic decisions.

Monetary education and learning empowers individuals to take control of their monetary health by equipping them with the required abilities and knowledge to navigate the intricacies of individual money confidently. This empowerment prolongs beyond the prompt resolution of debt issues, promoting a lasting frame of mind of monetary obligation and freedom. By finding out how to efficiently handle their funds, people can construct a solid foundation for a protected monetary future and job in the direction of attaining their objectives and ambitions.

Credit Rating Renovation Approaches

When it comes to boosting one's credit history, executing efficient techniques is important for accomplishing financial stability and securing desirable borrowing terms. One basic method is to make sure timely settlements on existing debts. Repayment background contributes dramatically to credit report, making it crucial to pay bills on time. In addition, minimizing debt card equilibriums can positively influence debt ratings. Maintaining credit rating utilization listed below 30% of the available restriction shows responsible credit monitoring. On a regular basis keeping track of credit scores records for errors and inaccuracies is an additional important strategy. Dealing with any type of inconsistencies promptly can protect against prospective damage to credit rating. Furthermore, limiting the variety of new credit applications can assist keep a stable credit profile. Each application creates a difficult questions, which may momentarily decrease credit history. Lastly, keeping old accounts open can profit credit report by showcasing a longer credit report. By integrating these credit report score renovation techniques, people can lead the way towards a much healthier economic future.

Settlement With Lenders

As individuals make every effort to boost their credit scores with reliable strategies such as prompt payments and debt utilization management, working out with lenders arises as a pivotal action in attending to monetary difficulties and financial obligation obligations. Settlement with financial institutions entails reviewing repayment terms, rates of interest, or perhaps you could check here negotiations to ease the burden of debt. Specialist debt counseling services play an essential duty in helping with these negotiations by leveraging their market knowledge and connections with creditors.

Among the key benefits of enlisting skilled credit scores therapy services for settlements with creditors is the capability to develop a structured payment strategy that aligns with the person's economic situation. These experts can support on behalf of the borrower to get to favorable terms, such as minimized rates of interest or prolonged settlement routines. By participating in meaningful conversations with creditors, people can frequently locate mutually helpful solutions that assist minimize financial tension and lead the way in the direction of boosted financial stability.

Continuous Assistance and Advice

Providing continuous support and instructions, expert credit counseling services provide very useful continuous assistance to people navigating their economic challenges and making every effort towards boosted credit scores health. This continuous support is critical in assisting customers remain on track with their financial objectives and make informed choices concerning their credit score administration. Through routine check-ins, individualized guidance, and customized financial strategies, credit history therapists ensure that people obtain the needed assistance throughout their trip to monetary security.

One key element of ongoing support offered by credit history counseling services is the establishment of long-term economic methods. Counselors function carefully with clients to develop practical budget plans, set possible monetary objectives, and establish sustainable finance habits. credit counselling in singapore. This aggressive technique helps people not only resolve their current economic problems but likewise build a strong foundation for lasting monetary success

Furthermore, recurring assistance from debt counselors can help people browse unforeseen financial difficulties, such as emergencies or adjustments in earnings. By having a devoted specialist to transform to for guidance and support, customers can feel extra certain in their financial decisions and far better geared up to take care of any type of financial obstacles that may arise.

Conclusion

To conclude, employing experienced credit therapy solutions offers customized financial debt administration strategies, economic education, credit rating renovation strategies, settlement with financial institutions, and recurring support and support. These benefits can assist people attain financial liberty and enhance their total economic health. By utilizing the expertise and sources provided by credit report counselling services, individuals can take control of their finances and work towards a much more secure and secure monetary future.

Eventually, customized financial debt management plans supply an all natural option to assist individuals conquer their economic difficulties and the original source work towards a brighter financial future.

Via routine check-ins, personalized advice, and tailored economic plans, credit scores therapists guarantee that people receive the needed support throughout their journey to economic security. - credit counselling in singapore

These advantages can help individuals attain financial flexibility and improve their general financial wellness.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Christina Ricci Then & Now!

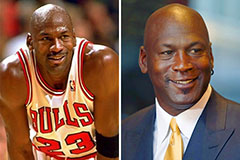

Christina Ricci Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!